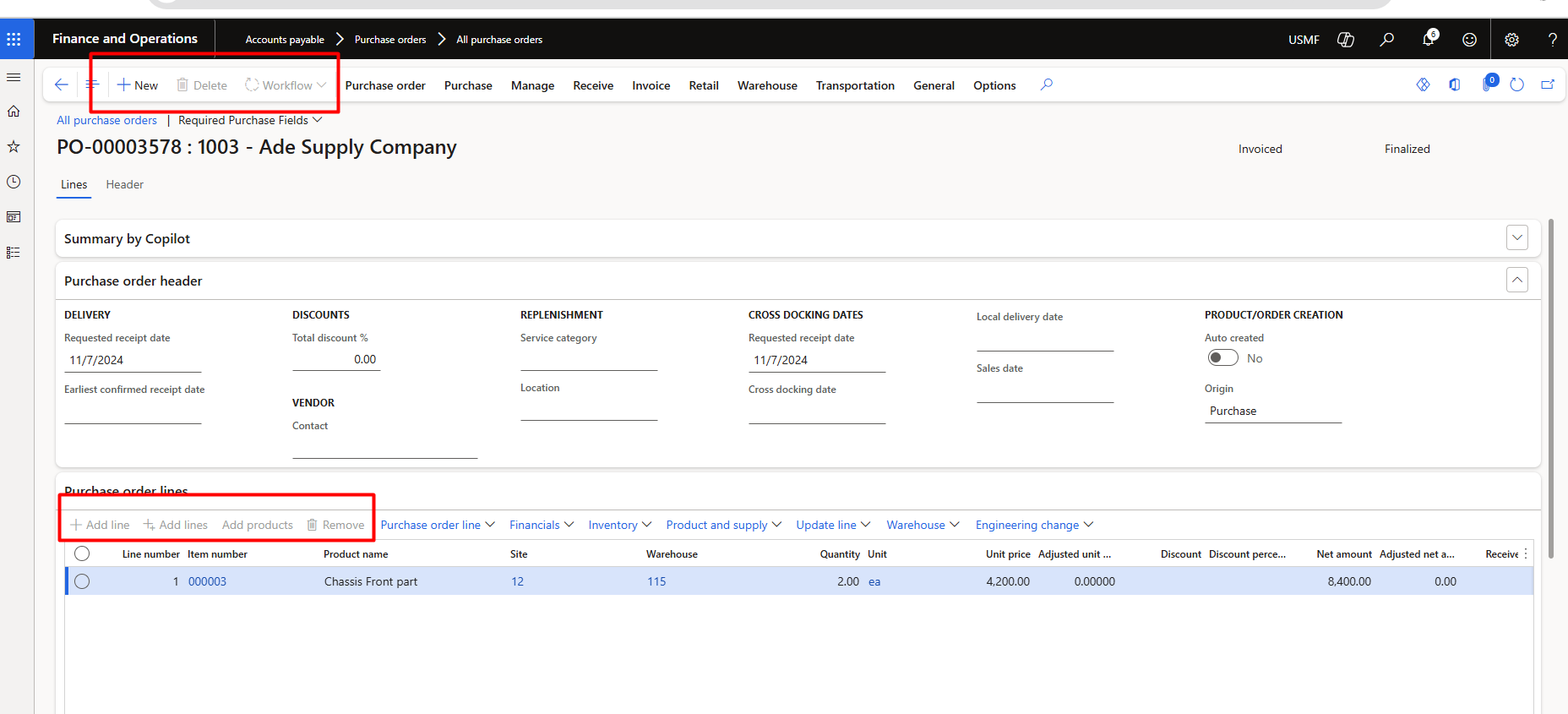

I conducted an experiment to see what happens when we create a service item but select the item group as stocked.

To test this, I created an item called “Service 101” using the FIFO model, which is typically used for stocked items.

Next, I purchased it as a normal item.

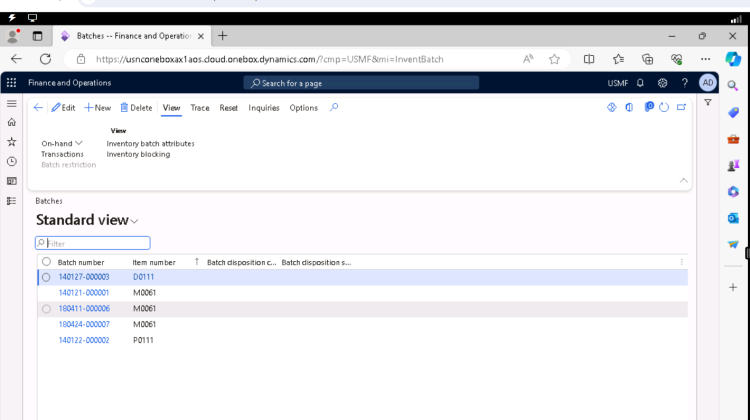

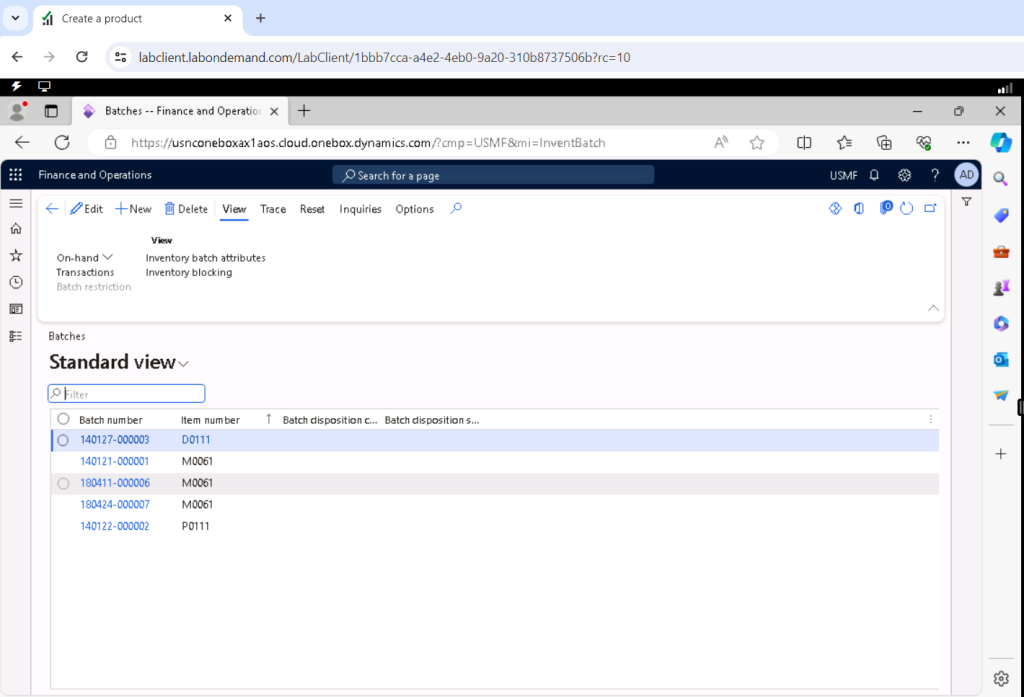

When I checked the inventory transactions, I noticed that transactions were recorded—this happened because the FIFO item model treats it as a stocked item.

Inventory transactions

Why would we need such an item?

If we define an item as a service and assign it to a non-stocked item group, it means we can use it as a service charge—either as a service received or provided to a customer. In this case, no inventory transactions would be recorded.

However, in production orders, when defining the Bill of Materials (BOM), there are certain non-physical costs (such as floor charges) that need to be accounted for. The problem is that BOM does not support service items.

To work around this, we need to create a service item using a stocked item model, ensuring that it can be included in BOM calculations while still serving its intended purpose as a service-related charge.